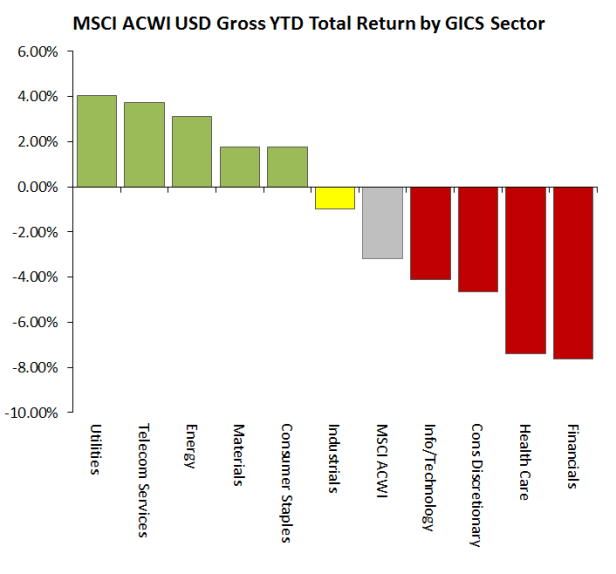

Per the following chart, Utilities and Telecom are the best performing global equity sectors year-to-date. Further, of the five Global Industry Classification Standard sectors boasting positive total returns through March 11, three are defensive sectors (Health Care, the second-worst performer on the year, is the only defensive sector that failed to earn this honor).

Our longer-term momentum work suggests Telecom and Utilities are likely to exhibit leadership into the Fall (a la 2014), however, we are willing to bet that a breather is in order following the strong absolute and relative runs exhibited thus far in 2016.

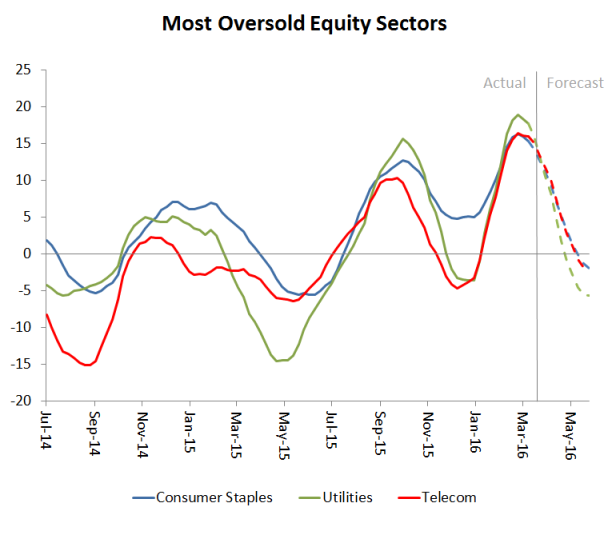

Medium-term relative momentum trends at the sector level, for one, argue that investors should rotate away from a defensively biased equity portfolio. The following exhibit illustrates weekly momentum trends for the outperforming defensive sectors versus global equities (we use the iShares ETFs, $KXI, $JXI and $IXP to proxy global defensive sector stocks, and $ACWI to represent global equities broadly).

Note that relative momentum has plateaued for each of these equity market cohorts and appears slated to worsen through May – as far forward as our model can anticipate. Moreover, relative momentum is forecast to meaningfully breach the neutral (zero) bound for each of these leading sectors. This last observation lends additional merit to the expectation for a medium-term reversal.

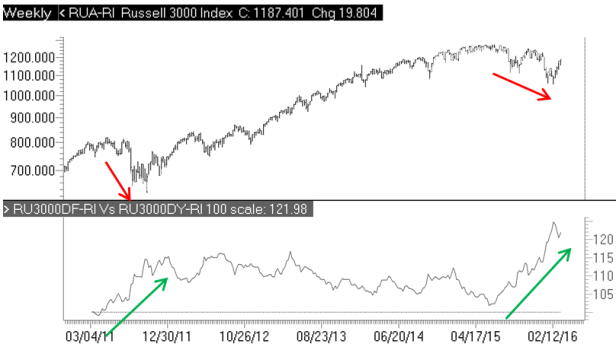

The character of the broad market too supports the idea that, over the next several months, defensives are likely to underperform. The top pane of Exhibit 3 shows the price of the Russell 3000 Index over approximately the last four years. The bottom pane illustrates the relative performance of the Russell 3000 Defensives Index relative to the Russell 3000 Dynamics Index (a proxy for defensives vs. cyclicals).

Note in the chart that the two recorded instances of protracted outperformance from defensives (in 2011 and 2016)—highlighted by the green arrows in the lower pane, coincided with periods of broad market weakness—indicated by the red arrows in the upper pane.

This observation fits with intuition and conventional wisdom, which suggest that defensives tend to come into vogue especially during trying times for the broad market, as investors become endeared to these firms’ relative financial stability when growth assumptions appear dubious.

Exhibit 4 illustrates the price path and the condition of medium-term momentum for the broad global equities market (as proxied by the iShares MSCI ACWI ETF). Observe that weekly momentum appears slated to rise (up through the zero line – an important threshold) into late May. Accordingly, we anticipate rising share prices over this horizon.

Thus, if our supposition that a multi-month period of risk-on is underway for global stocks, history suggests it indeed likely that defensives will cede control to more cyclically levered areas of the equity market.

Sentiment signals, in addition to top-down and bottom-up momentum studies, likewise call for equity market strength and the rotation away from defensives. For instance, Jason Goepfert, of Sundial Capital Research, has observed that when sentiment for Staples and Utilities become frothy (a state defined by these defensive areas advancing to within 5% of their all-time highs, while other sectors are at least 5% below their highs), stocks have rallied by an average (median) rate of 4% (4.4%) over the coming month. These results compare to average returns over Goepfert’s examination period of about 1% per month.

(Goepfert also noted excess returns after three months following periods when defensives were all the rage. This timeframe parallels the average expected horizon of our medium-term momentum-based calls. However, he could not establish statistical significance for the outsized returns generated over this longer horizon.)

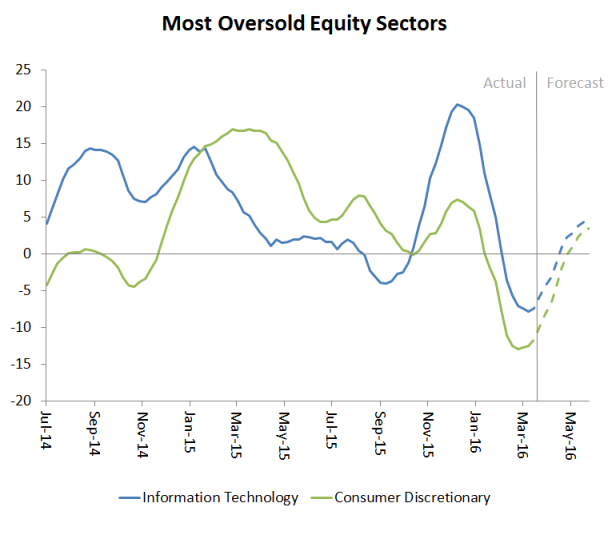

Former darling sectors, namely Technology and Consumer Discretionary, appear the most timely portfolio additions. Both areas have lagged the broader market YTD, but, per Exhibit 5, a turn in relative momentum for Technology appears imminent, while weekly momentum for global Consumer Discretionary stocks vs. ACWI bottomed two weeks ago. We expect relative momentum for both sectors to improve (notably, through the zero line) into May, providing support for new leadership over this timeframe.

Momentum aside, other avenues of exploration support the notion that Discretionary and IT should post some manner of revival in weeks and months to come. To wit, The Leuthold Group has found that prior winners tend to perform best during the last 12 months of cyclical bull markets. (Given that (1) at over seven years old, the current cyclical bull has persisted longer than the life of the average post-war expansion of 58 months, (2) the FOMC has already embarked on the process of policy normalization, and (3) recent sector-level performance is absolutely consistent with the late-cycle playbook, we do not deem it a stretch to estimate that the current expansion is long-in-the-tooth.)

Against this backdrop, it appears more than a mere coincidence that the two best performing sectors since the Great Recession low was forged are the very same areas our framework is calling on to ascend to the forefront of the equity market landscape.

Our final chart offers a stylized illustration of the medium-term condition of each of ten GICS global equity sectors. We use the iShares MSCI ACWI ETF as a barometer for global equity performance, and the suite of iShares global equity sector ETFs to proxy attributes of specific sectors.

For context, our framework generally regards bouts of outperformance and underperformance for a stock/sector/geography/style as alternating phases of market cycles. Thus, we expect that strong periods of relative performance foreshadow weakness to come, and vice versa. By increasing allocations to stock market cohorts with bottoming relative momentum, we endeavor to amplify exposure to segments of the market that are on the cusp of commencing outperformance cycles (or at least in the early stages of their relative runs). Similarly, we attempt to reduce exposures to areas believed to exhibit peak momentum readings, as this condition commonly coincides with soft future returns versus the market.

Stay tuned!